The Bullish Case for Bitcoin

With the price of a bitcoin surging to new highs in 2017, the bullish case for investors might seem so obvious it does not need stating. Alternatively it may seem foolish to invest in a digital asset that isn’t backed by any commodity or government and whose price rise has prompted some to compare it to the tulip mania or the dot-com bubble. Neither is true…

Stone Ridge 2020 Shareholder Letter

Modern central banking is the cause of severe economic downdrafts, not the cure. By giving in to the clamor for ever more abundant and ever cheaper money, central banks cripple the role of the wisest regulator, the market, of the most important mechanism for efficient, economy-wide allocation of capital: relative prices of sound money.

Addressing Bitcoin Criticisms

While Bitcoin’s open-source software may be forked, its community and network effects cannot. Bitcoin makes trade-offs for core properties that the market deems valuable. Bitcoin is not backed by cash flows, industrial utility, or decree. It is backed by code and the consensus that exists among its key stakeholders.

Gradually Then Suddenly

Hayek writes about the price mechanism as the greatest distribution system of knowledge in the world (The Use of Knowledge in Society). When the money supply is manipulated, it distorts global pricing mechanisms which then communicates “bad” information throughout the economic system. When that manipulation is sustained over 30-40 years, massive imbalances in underlying economic activity are created which is where we find ourselves today.

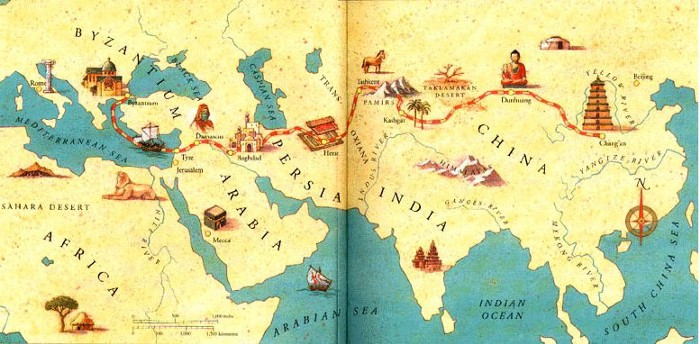

Speculative Attack

A speculative attack that seems isolated to one or a few weak currencies, but causes the purchasing power of bitcoins to go up dramatically, will rapidly turn into a contagion. For example, the Swiss will see the price of bitcoins go up ten fold, and then a hundred fold. At the margin they will buy bitcoins simply because they want to speculate on their value, not due to an inherent problem with the Swiss Franc.

Winning Hearts and Minds for Bitcoin

Among the six foundations, liberty is Bitcoin’s true cornerstone, and it is the one on which Bitcoiners must lean hardest. Money that is hard to print, censor or steal is a powerful tool for liberty and against oppression. Whether storing value from corrupt regimes in hyperinflationary countries or escaping oppression by safely crossing borders with one’s savings in a brain wallet, Bitcoin resonates strongly with anyone who values liberty.

Real Estate Before and After Bitcoin

Some businesses or even whole industries may not survive hyperbitcoinization. For example, it is hard to imagine a banking and finance industry anywhere near its current size. Similarly, with hard money creating actual trade-offs rather than endless expansion, governments will be forced to shrink dramatically. Demand for office space could be decimated for some time.

9-Minute Read That Will Change Your Life

I’m not advocating for Bitcoin as an investment, although I do think it’s worth owning a little. I’m just trying to set the record straight on a few misconceptions and help newcomers to the Bitcoin community get up to speed quickly with a few key concepts. Hopefully, if you’re reading this with an open mind, you’ll realize quickly that there’s much more to Bitcoin than its price.

Many More to Come…

Bitcoin Services

Managed Custody Solutions

Bitcoin & Crypto Mining

Balance Sheet & Treasury Conversion

Point of Sale Integration

Staff Training & Consulting